Ease of Use

TT is powerful, yet easy to use. It only takes minutes to create your account using web-based risk and administration tools. There’s no software to download or install for you to begin trading so you can begin trading quickly.

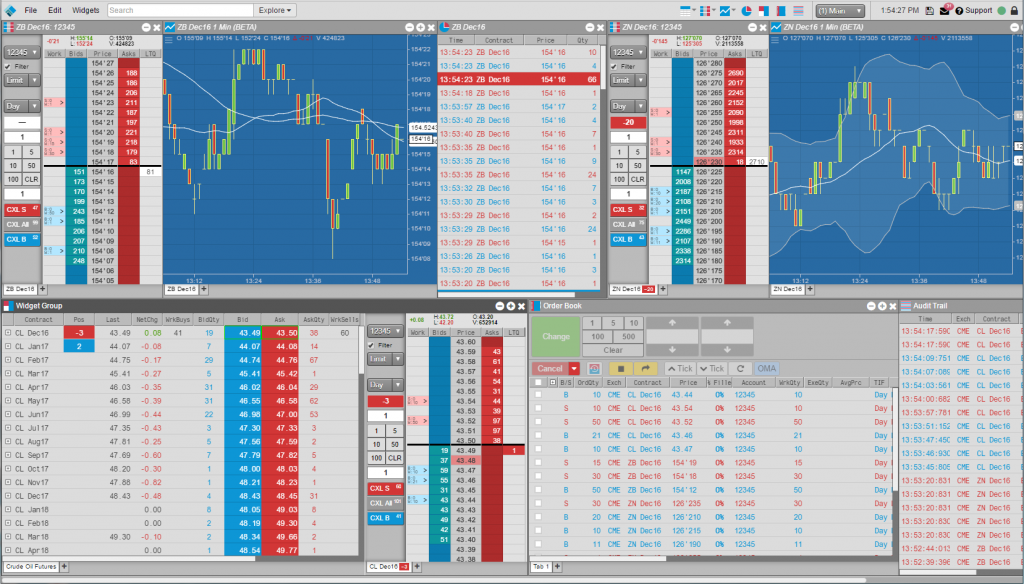

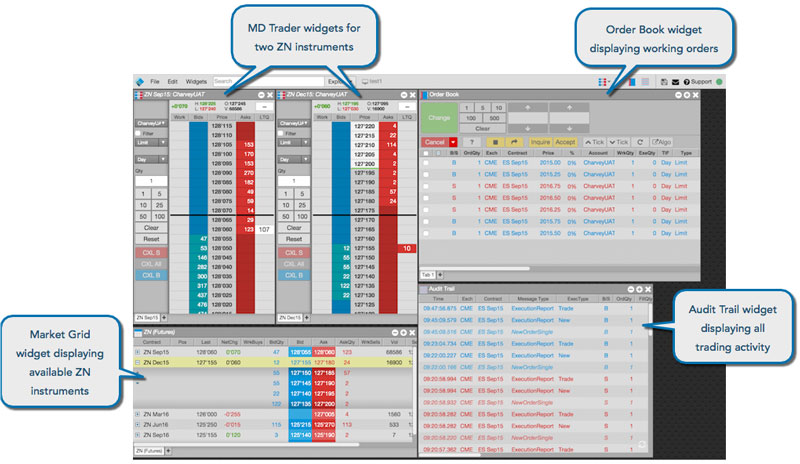

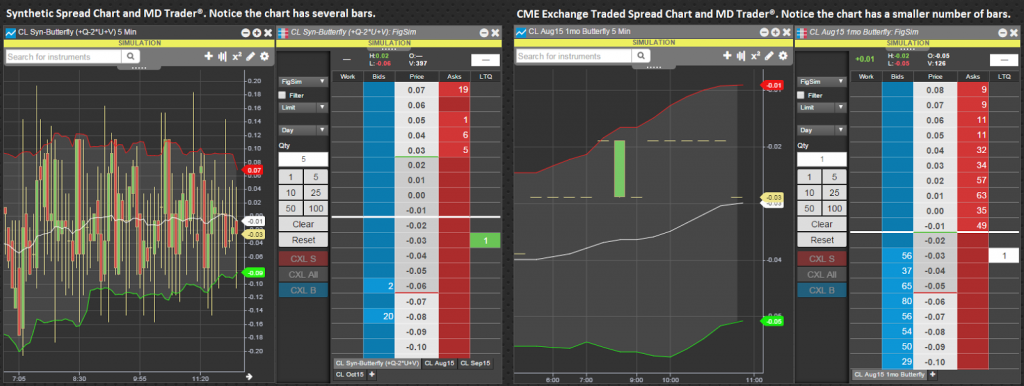

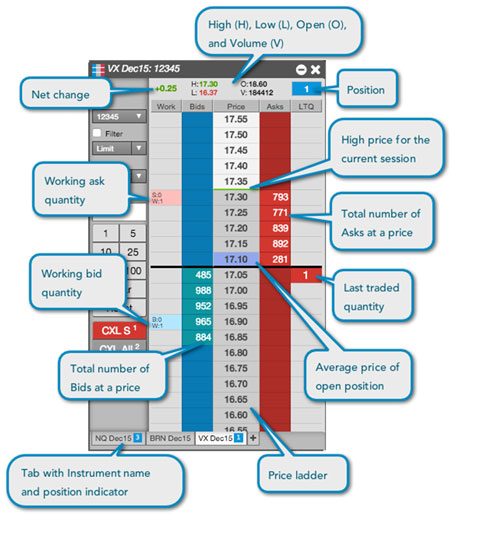

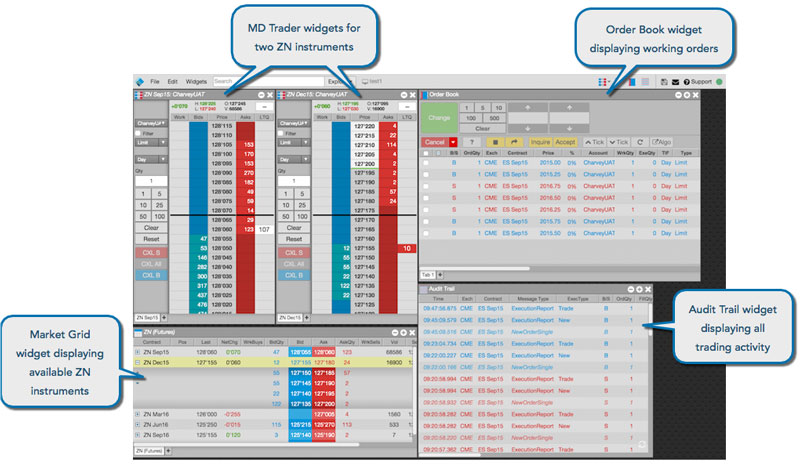

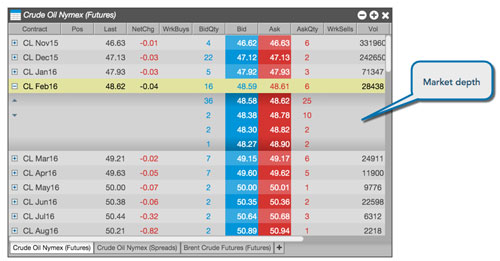

A web interface with search-based navigation provides a streamlined, easy path to contract discovery and order execution. Quickly find instruments and products with a just a few keystrokes using TT’s intuitive search functionality. Easily create workspaces using widgets such as MD Trader, charts, Autospreader and more. You can retrieve saved workspaces from any computer, including a desktop or laptop, with TT.

What’s more, the open architecture makes it easy to customize your experience, and equally easy for third-party applications to integrate with TT. The solution allows nearly limitless capabilities for business intelligence of trade data recorded from the inception of an account.