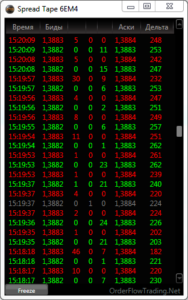

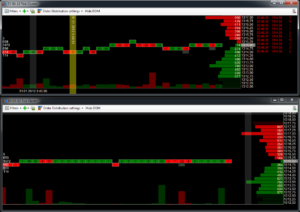

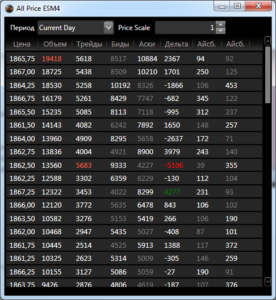

Advanced TS powered by Rithmic , CQG, and CTS data technology is a professional trading and analytical platform designed for order flow analysis. It has all traders need for fast and convenient market evaluation – Time And Sales, Level II data (Depth of Market or DOM) and HFT algorithms tracking. ATAS platform processes the order flow data and visualizes it in an intuitive form. It features extensive filtering capabilities and flexible setup. Advanced TS analytical instruments improve the information value of the market data.

Server co-location is available for traders wanting closer proximity and lower latency connection though a Dedicated Trading Server, or Virtual Private Server.

Advanced TS Platform Fee

-

1 Month: $74

-

3 Months: $195

-

6 Months: $330

-

12 Months: $540

-

Lifetime: $1,990

Data Technology Fee

-

Rithmic – $20/Month + $0.25/Contract

-

CQG – $10/Month + $0.10/Contract

-

CTS – $25/Month + $0.50/Contract

-

CTS Fee Cap – $500/Month