Call Us: (312)241-1982

R | Diamond API™

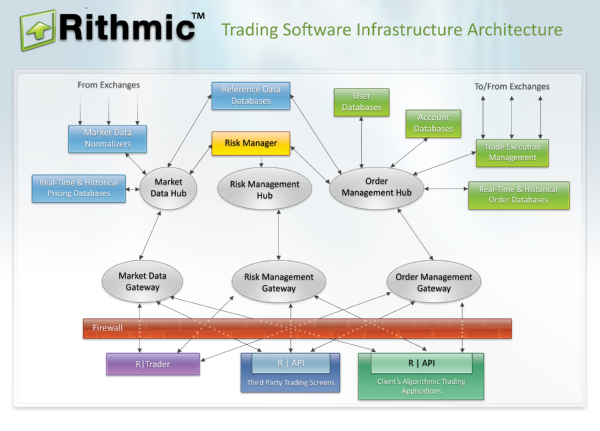

Rithmic Trade Execution Software Infrastructure Architecture

R | Diamond API™ is R | API™ but with access to R | Trade Execution Platform’s ultra-low latency and high frequency trading capabilities. R | Diamond API™ contains R | API™ but also enables its caller to connect directly to Rithmic’s exchange facing gateways and to connect to Rithmic’s market data handlers.

A program that incorporates R | Diamond API™ (also referred to as a Diamond Program) connects to R | Trade Execution Platform as any program does that incorporates R | API™, but, subject to Rithmic’s exchange entitlements processing, it also connects directly to Rithmic’s market data handlers instead of connecting to Rithmic’s ticker plant and it also connects directly to Rithmic’s exchange facing gateways. A Diamond Program submits orders to R | Trade Execution Platform marked to be held, so that when they have passed Rithmic’s pre-trade risk compliance, they rest in Rithmic’s exchange facing gateways. As the Diamond Program gets market data from Rithmic’s market data handlers it evaluates that market data with an eye toward releasing orders. When a Diamond Program decides it is time to release an order to an exchange, it simply sends a small message to one of Rithmic’s exchange facing gateways indicating the order number to be released and the price at which the order is to be filled.

Traders using Diamond Programs realize transit times (the time just before market data is read until the time just after an order is released to an exchange based upon that reading of market data) of less than 250 µseconds (actual times vary and are generally faster).

R | API™ Users:

-

Grey box and black box traders

-

High frequency traders

-

Scalpers

-

Proprietary trading houses

-

Trading screen designers/programmers

-

Screen traders

-

Risk managers

-

Banks, including foreign banks

-

Third party education providers