Call Us: (312)241-1982

Investor/RT

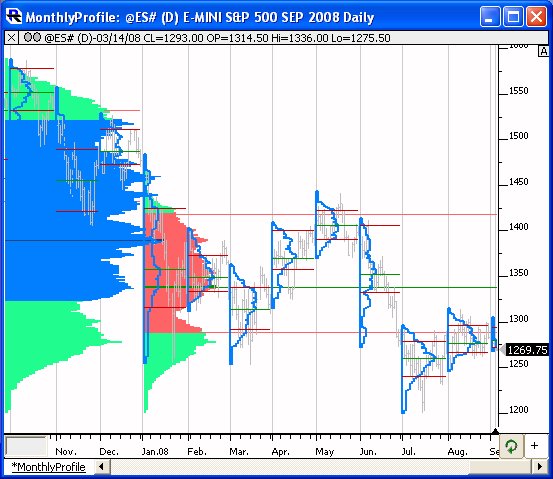

Profile Indicator (PROF)

The Profile indicator enables the user to overlay a price-based profile over a multi-pane intraday chart. The Profile provides a “Price/Row” preference which dictates the height of each row. The width of each resulting row will represent how many bars during the session in which that row’s price range was touched. If the periodicity of the chart is 5-minute, and the width of a row is 3 bars wide, then the range of three of the 5-minute bars for that session actually overlapped the price range of that row. The widest row is called the Point of Control (POC). The Value Area (VA) is commonly considered the area in which 70% of the price action transpired. This percent level is adjustable, as some prefer to use alternate VA % levels such as 80%. Options for drawing the current and previous POC and VA lines are provided in the Profile preferences. Another option dictates how many sessions for which the Profile will be computed and displayed. The Profile may be drawn as Solid or Hollow Blocks, Solid or Hollow Ovals, Dots, or Lines. A “Hide Profile” checkbox gives the user the ability to hide the actual profile and draw only current and/or previous POD and VA lines. The “Current” and “Previous” POC and VA lines are also optional, as well as VA and POC labeling.

Volume Breakdown (VB)

The Volume Breakdown is a powerful and flexible indicator used to gauge buying and selling pressure. It looks inside each bar, breaking down and classifying each tick and then accumulating the results (accumulation is optional), and further giving the user a variety of statistical measures (including all built-in technical indicators) to apply the these results. The most common use of the VB indicator is to calculate the delta (difference between the buy (ask-traded) and sell (bid-traded) volume) of each bar. Positive deltas signify more buying pressure, while negative deltas signify more selling pressure. The magnitude of the delta determines the strength of that pressure. Expect to see positive deltas during uptrends and negative deltas during downtrends, but look for delta turning negative at highs, or turning positive at lows…a sign of possible market turns and good entry/exit points.

With the VB indicator, the Delta can be computed, accumulated, and run through a variety of statistical/indicator computations.

The VB indicator is unique in that it loads tick data (when initially computing) regardless of the timeframe of the chart, in order to breakdown the volume of each trade, and calculates on each tick. While it may take a few moments to initially add VB to a chart, or load a chart which involves VB, the VB indicator is designed to calculate very efficiently on a tick-by-tick basis, regardless of the combination of settings selected.

Session Statistics (SESST)

The Session Statistics Indicator computes historical statistics for an instrument or an indicator. The The Session Statistics preferences use the general format: [Statistic] of [Price] of the [First/Last] X [Minutes/Bars] of the Session The Statistic options include:

-

Highest Price

-

Lowest Price

-

Range of Price

-

High/Low Range

-

Average Price

-

Sum of Price

A standard list of Prices is provided as follows:

-

Close

-

High

-

Low

-

Open

-

OHLC/4

As an example, a user may want to access the “Highest High of the First 30 Minutes of the Session”. This indicator makes that operation very quick and easy. The result will be as follows. Let’s assume in our example we are looking at 10-minute data. On the first bar, the result will be the high of that first bar (first 10 minutes). On the second bar, the result would be the highest high of the first two bars (first 20 minutes). Then, on the third and remaining bars of the session, the result would be the high of the first 3 bars (first 30 minutes). Then on the first bar of the following session, the result will again reset to the highest high of that first bar, and everything starts over again. To see the effect, simply add the indicator to a chart.