Call Us: (312)241-1982

InsideEdge Trader

InsideEdge Trader Version Overview

Standard version is a complete charting and trading platform. The software uses accurate realtime data sourced from IQFeed, historical data, multiple order entry tools, including trading through the charts, unlimited simulation, complete and customizable charting indicators, and drawing tools.

Automation version adds the ability to build trade strategies with a simple dialog based interface. This version also allows you to take signals from third party platforms such as Trade Station and route them to your broker of choice.

Professional version adds advanced tick by tick order flow analysis in simple to view charts with split volume, cumulative delta studies and the institutional volume filter. This version is a must have for the serious trader that want to watch the auction market process in action.

Chart Trading

Trading through the charts is the easiest order entry method with InsideEdge Trader. Trade by clicking on the price bars or candles to enter and manage trades. Chart based trading is the easiest method of order entry. Several different traditional depth of market (DOM) screen are available to fit different styles of trading. These screens displays the market depth and highlights the bid/ask.

DOM Order Entry

Multiple Depth of Market (DOM) windows allow the user to track the markets, orders, and positions through their choice, the Simple DOM, Scalping DOM, or Multi (3x) DOM.

Complete Charting Package

InsideEdge Trader includes unlimited charts in any increment for any futures market. The charts have several years of accurate tick data directly from the exchanges. The charts can be configured in any time frame, tick, renko, volume, heikin-ashi, or range-bar based internals and can include any indicator.

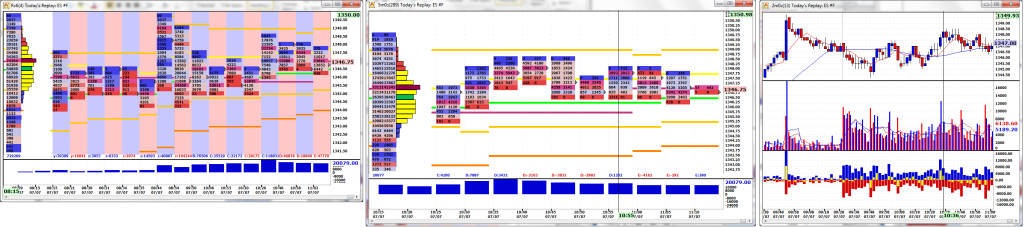

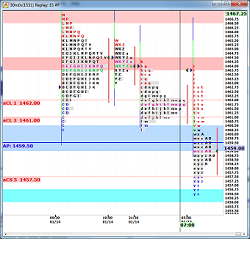

Market Profile

One of the few platforms developed for Market Profile traders, Inside Edge allows you to gain and understanding of markets that was previously reserved for exchange members only. By combining time, price, and volume in one display, you are enabled to analyze and reveal pricing patterns from any market as they develop.

Order flow analytics delivers volume study indicators with trade size filtering such as cumulative delta, split volume and Buy/Sell differentials. Use long term Volume Profiling histograms with trade size filtering to help identify market structure. Learn when institutions are coming into the market using the institutional volume filter to track the bid/ask activity at any point in time.

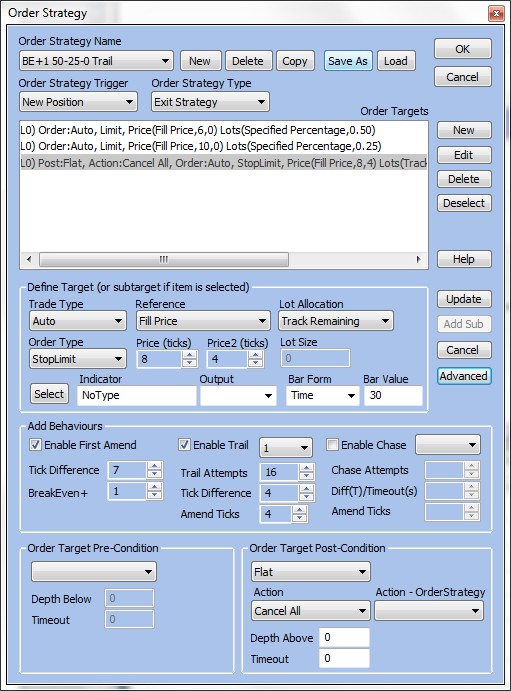

Advanced Order Strategies

Advanced Order Strategies provides an easy interface to build advanced combinations of intelligent orders such as bracket orders, trailing stops, indicator trailing stops, average price and net position tracking.

Configure a combination of intelligent orders to create the desired behavior for entering or exiting a trade. Each order can be setup to automatically modify its price or volume depending on external conditions. Pre and Post conditions defines what should happen prior to or after an order completes (filled or canceled).

Automated strategies built in third party software such as TradeStation or eSignal can be configured to take advantage of the speed of Rithmic on InsideEdge Trader.

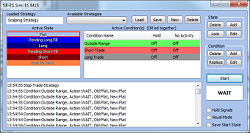

Strategy Builder

Using the principles of state-event machines, time sequenced strategies can be built that allows step by step condition evaluation prior to triggering a trade. No programming skills are required since the strategy is created using built in dialogs and menus. This tool also allows integration to TradeStation, eSignal, or 3rd party software.

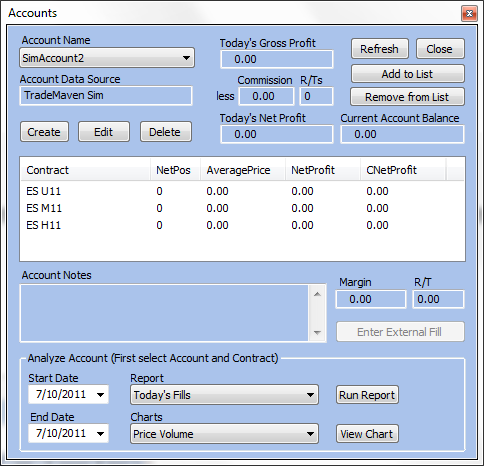

Account Manager

The account manager provides a summary view of the existing accounts including both simulated and live, information on markets that have been traded on each account, as well as the last recorded position. Run fill reports on each account for advanced performance statistics and analysis.

Market Replay

Replay tick by tick market data in real time or speed up the replay to practice trading during off hours to backtest developed strategies.