Call Us: (312)241-1982

Quick Screen Trading

Quick Screen Trading (QST) powered by Rithmic and CQG data technology is a state of the art futures and options trading application combining comprehensive, fast, flexible order entry management with world class charting and analytics, real time quotes and news.

Main Features

Quick Screen Trading (QST) features the ability to enter and manage orders and fills from virtually any screen. It also offers integrated paper trading, allowing users to learn the QST interface and practice trading strategies. With the click of a button, users can toggle between paper and live trading. Also includes synthetic orders, such as trailing stops, Iceberg, and auto spreads.

-

Invalid order requests are halted and the user is notified before the order is ever submitted

-

All prices are displayed in a consistent format, with the correct decimal and minimum tick. One click trading means the user typically doesn’t type in the price, but can easily modify it

-

One click trading means the user typically doesn’t type in the price, but can easily modify it

-

Trade directly from the charts, trade window, or Chart DOM.

Charts

-

Large number of Technical Indicators with programmable parameters

-

Over 20 different drawing tools such as trend lines, channels and Fibonacci retracement

-

Tick, volume, price change, intraday, daily, weekly, monthly and quarterly time resolutions

-

Bar, Line, Area and Candlestick chart types

-

Import chart from Excel

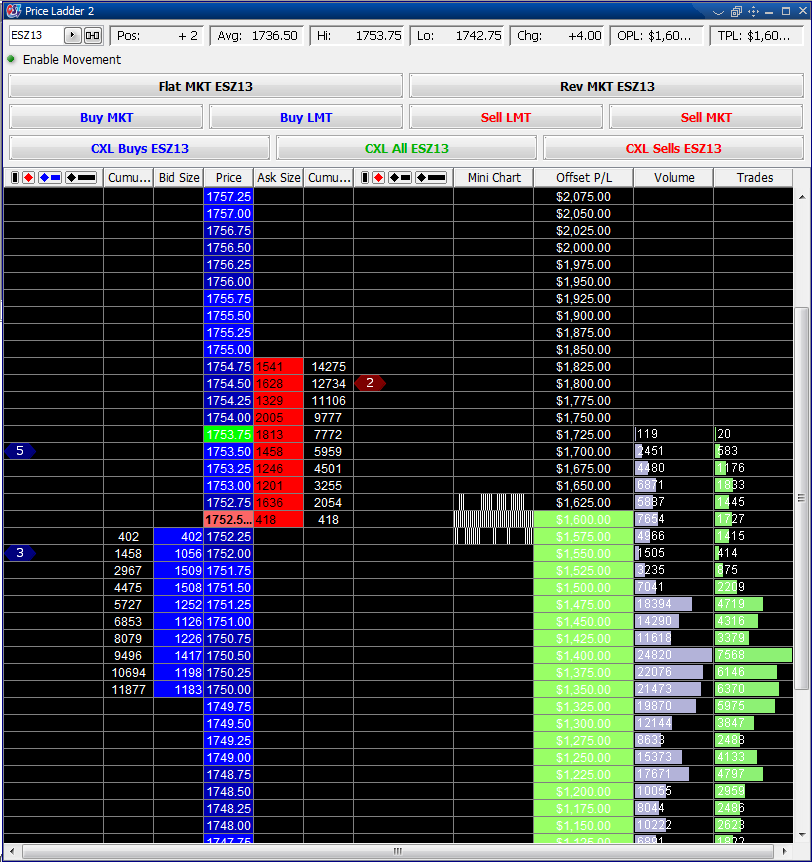

Price Ladder

-

Prices organized in a static column

-

Real-time display of position, average price and profit/loss

-

Easy switch between implied, outright or combined data type

-

Optional display of cumulative bid/ask columns

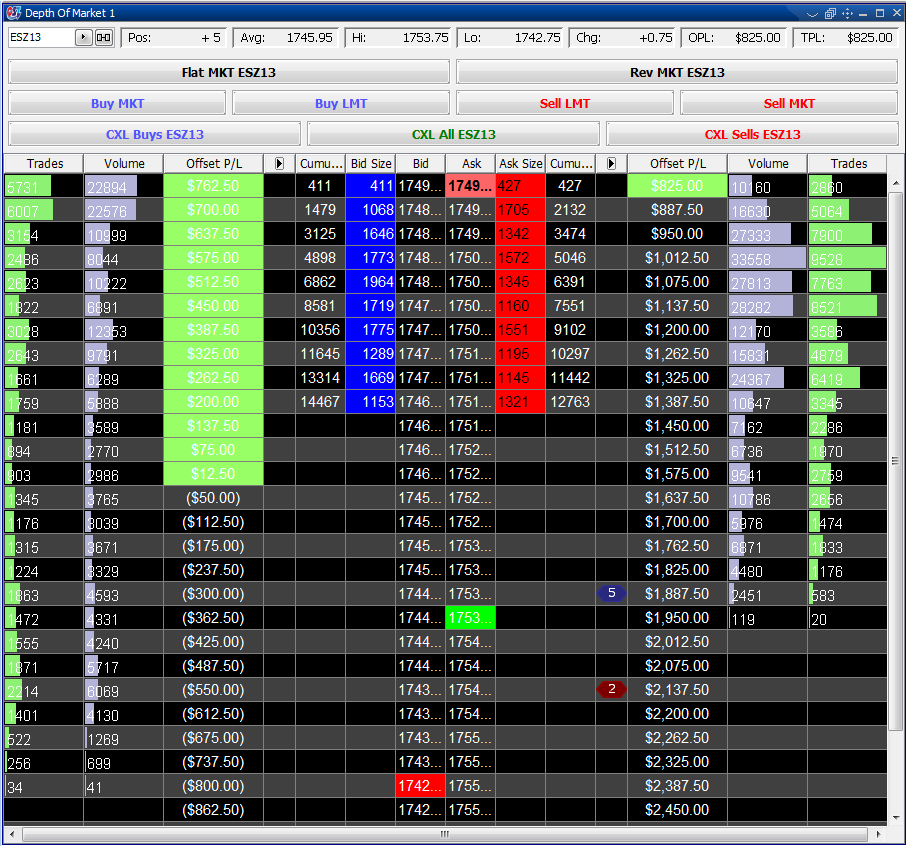

Market Depth

-

Best bid and best offer float at the top of the display

-

Configurable pause freezes the display when mousing over configurable regions of the display

-

Easy switch between implied, outright or combined data type

-

Optional display of cumulative bid/ask columns

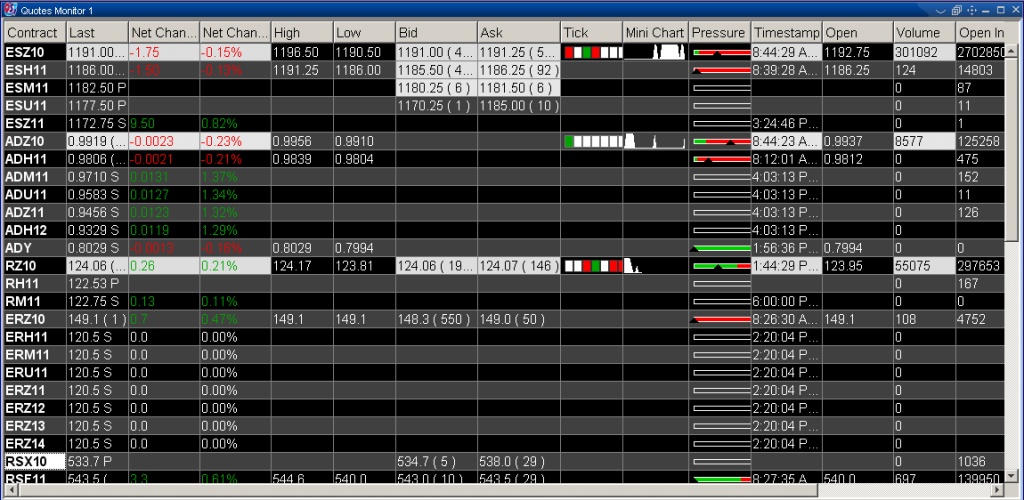

Quotes Monitor

-

Launch Charts, Option chains or market depth windows at right click

-

Toggle between one click-trading or selection mode

-

Alarms to notify the user when a certain price limit is reached

-

Order entry functions, including Contingency orders and Spread Legger

Orders and Positions Monitor

-

Shows all your orders and positions and their status, grouped by net positions

-

Filtering capabilities: expand or collapse all net positions; show/hide fill positions, open positions, working orders, rejected orders, cancelled orders, cancel/replaced orders, parked orders or suspended orders

-

Status bar which displays the futures, options and net profit/loss

-

Export to Excel capabilities

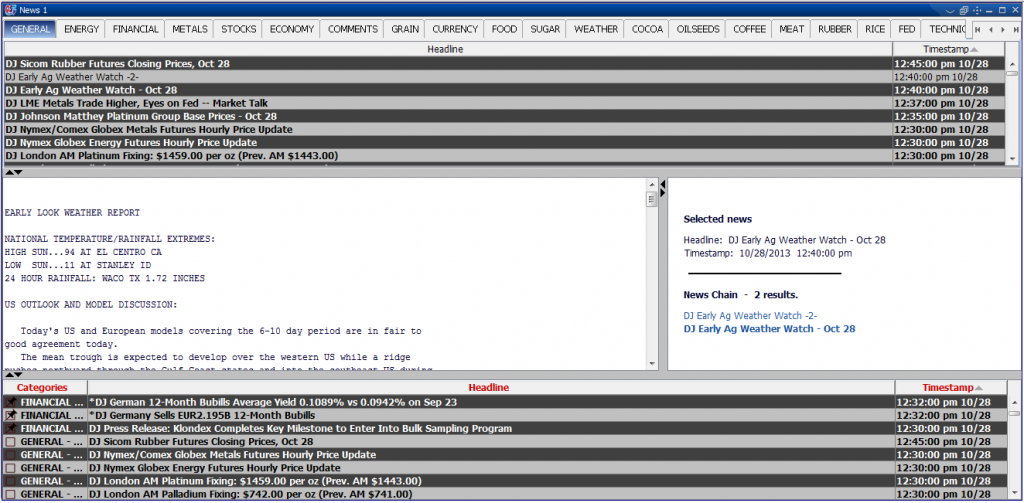

News

-

News sources include Dow Jones, Reuters and LaSalle Street News

-

Custom news searches are saved and organized in a separate tab for each search so you don’t need to re-enter them when you log back in

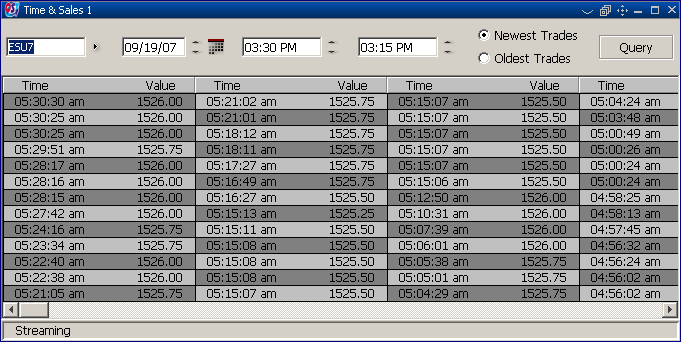

Time and Sales

-

Streaming real-time

-

Double click a price highlights all other trades at that price

-

Timeframe adjusts automatically based on the opening time of the contract when it is entered.

-

Launch Charts