Call Us: (312)241-1982

Jigsaw Trading

Jigsaw Trading powered by Rithmic and CQG data technology provides the clearest way to see if the behavior of traders really is changing as expected. Sometimes that means traders don’t get into trades because traders can see overwhelming trading against a position, sometimes it confirms trades and sometimes it helps traders to get in at a much better price. Jigsaw Trading mission is to deliver rich, meaningful and useful trading information, enabling traders to make more informed trading decisions both in entering and managing trading positions. Confidence in trading comes from knowing when traders are right AND knowing when traders are wrong about a trade. Jigsaw Trading gives traders the tools and the knowledge to make informed trading decisions.

The tools offer everything traders can expect from a traditional DOM and Time and sales but with many advanced features not present on traditional tools. The format is intuitive and easy to absorb. Experienced Proprietary traders have moved to the tools and been up and running in less than an hour. Jigsaw Trading presents information in a various different ways – numbers, histograms and power meters allowing traders to mix and match the display to accommodate specific preferences. Jigsaw Trading have advanced order entry features such as Queue Position display, one click order place, move and cancel as well as an “Order Cleanup” that prevents traders from inadvertently leaving orders open after exiting a position. Jigsaw Trading has alerts for various Order Flow “Events” that occur such as when a large trader is trying to hide their real size with an iceberg order.

Trade With A “WHY?”

A true trading edge can only come from understanding WHY other traders will push prices up or down after you enter a trade. Whether it’s short term speculation or long term institutional re-positioning, Jigsaw Trading provide the tools and information traders need to identify great trading opportunities.

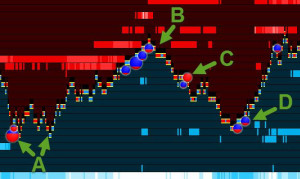

Get In Early, Stay In Longer

Regardless of how traders define WHERE to enter a trade, Jigsaw Tools clearly show shifts in trader behavior that help confirm/reject or refine a trade entry. Once in a trade, other traders’ behavior will tell if it’s still safe to stay in or need to get out, even if price isn’t yet moving against the position.

Tune Into The Market

Great traders know the only constant in the markets is change. As participation and behavior changes, so does volatility and that directly impacts the type of strategies used. Jigsaw Tools clearly show changes in participation as they occur, so that traders can take advantage of the changing conditions and not be a victim of them.

Jigsaw Trading Benefit

Whenever traders place a trade, they do so because they expect other traders to behave a certain way after entering the market. It doesn’t matter where traders want to get into the market or why; traders will benefit from knowing how the behavior of traders is developing as traders get to the point where they want to take a trade. Once traders are in a trade, they can monitor trader behavior and cut obvious losers before trades hit stop loss orders. The tools offer everything traders can expect from a traditional DOM and Time & Sales but with many advanced features not present on traditional tools. Using Jigsaw to observe the flow of orders and the effect on price gives traders an edge few traders have.

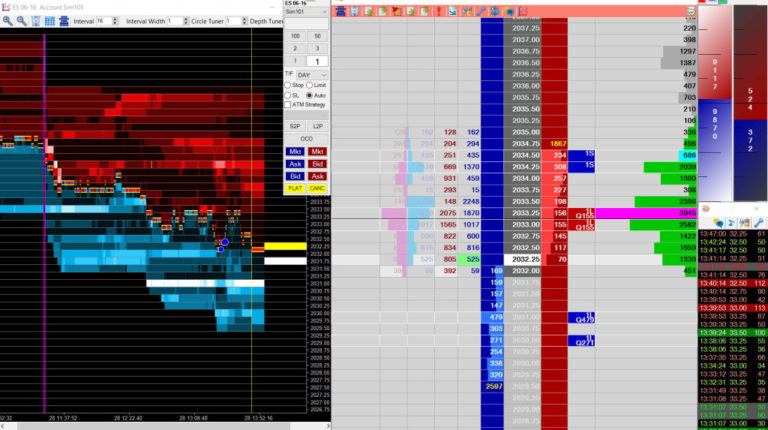

Depth & Sales

An innovative Trading DOM that goes far beyond the functionality of any other Trading DOM on the market. It is a fully integrated Order Flow tool giving traders an unparalleled view of market strength and manipulation. JigSaw DOM is the only DOM that clearly shows participants pulling and stacking order activity.

Realtime Order Flow Heatmap

Tracking trader behavior ‘right here, right now’ is essential in confirming and refining trade entry points and in managing trades. Jigsaw Tools clearly show

-

Shifts in trader participation

-

Where large size is trading

-

Order Book Manipulation/Spoofing

-

Post Entry Behavior for Trade Management

-

Consolidation Zones

-

Changes in participation

-

Changes in volatility

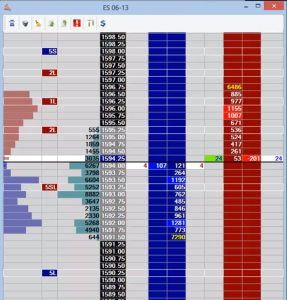

Historical Order Flow

Order Flow History gives traders additional trade entry points that would not be visible to chart traders as well as telling traders where real supply/demand lies.

-

Visual Bid/Offer Heatmap

-

Hidden backstops (invisible on price charts)

-

Supply/demand locations

-

Stop locations

-

High volume nodes – ‘reaction points’

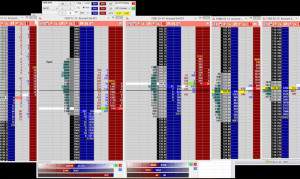

Order Flow Event Alerts

Unusual trading activity is often the first sign that a change in market direction is imminent. Audio and visual alerts tells traders when these Order Flow Events are occurring in real time.

-

Iceberg Orders

-

Buyer/Seller absorption

-

Delta Divergence

-

Block Trades

-

High volume nodes – ‘reaction points’

Free Education

Great tools are accompanied with great educational material that is 100% free. Following are just some of our educational courses:

-

Order Flow Foundation

-

S&P500 Trade Location

-

Trade Management

-

Trading summertime Chop

-

Volume Profile Analysis

-

Anatomy of a Reversal

User Community

Jigsaw brings traders together and we encourage traders to join the Jigsaw community:

-

Free Jigsaw Chat room

-

Jigsaw Members site

-

Customer YouTube pages

-

Customer blogs